A stablecoin is a cryptocurrency that is backed by another stable asset such as fiat currency (USD, EUR, JPY etc), gold and commodities. This is done to reduce the volatility of the coin by backing it with something that has a stable value.

What are the benefits of stablecoins?

Stablecoins were created in order to minimize the volatility of cryptocurrencies. It allows people to use a cryptocurrency that is stabilized and pegged to a specific value. Stablecoins retain the benefits of being a decentralized digital currency – low transaction cost, almost instantaneous transaction times, trustless and outside the control of a single entity – while avoiding price volatility.

For countries where inflation can render government-issued currency into meaningless pieces of paper in a short period, stablecoins can provide a welcome respite from uncertainty and hyperinflation.

For traders who want to hedge their investments, they can transfer their crypto holdings to stablecoins if they believe their cryptocurrencies will be dropping in value.

Usually stablecoins have an inverse relation to the crypto markets – when they are down, the trading volume and market cap of stablecoins increases, and when the crypto markets are up, stablecoins decrease.

What types of stablecoins exist?

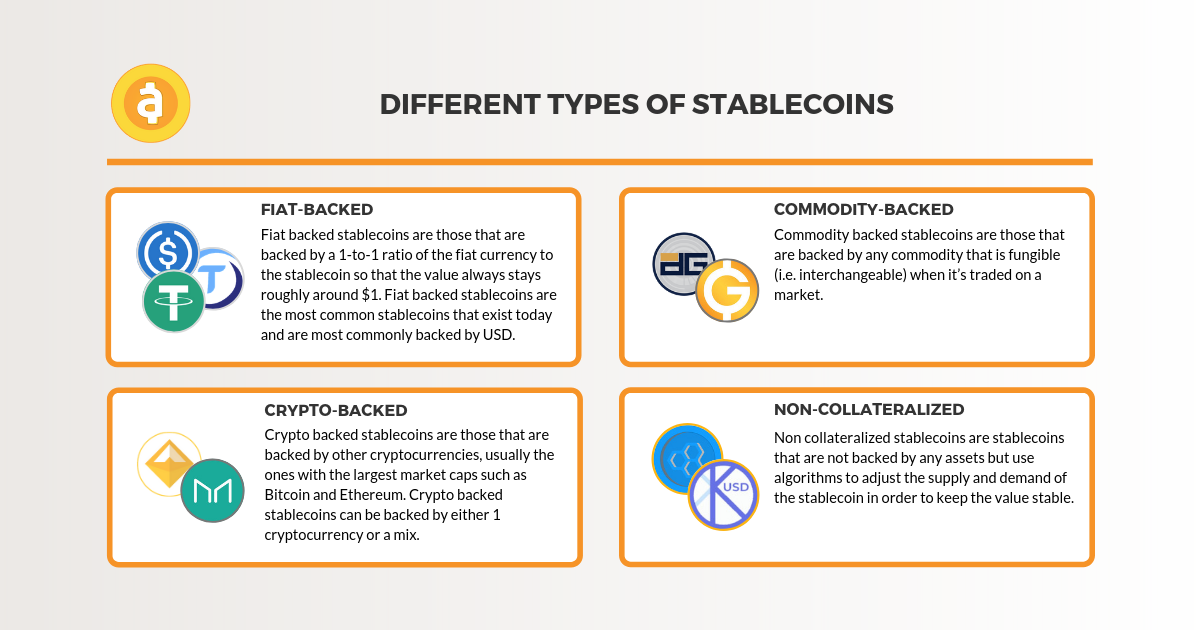

There are four main types of stablecoins with regard to collateral.

1. Fiat-backed stablecoins

Fiat-backed stablecoins are those that are backed by a 1-to-1 ratio of the fiat currency to the stablecoin so that the value always stays pegged to the traditional currency. Fiat-backed stablecoins are the most common stablecoins that exist today and are most commonly backed by USD. Examples of well-known, fiat-backed stablecoins are USDT (Tether), USDC (Circle), TrueUSD (TrustToken), PAX (Paxos) and GUSD (Gemini Dollar).

2. Commodity-backed stablecoins

Commodity-backed stablecoins are those that are backed by any commodity that is fungible (i.e. interchangeable) when it’s traded on a market. Examples of these types of commodities would be oil, precious metal or grain. Commodity-backed stablecoins are currently backed by either gold or oil.

Examples of well-known, commodity-backed stablecoins are DGX (Digix) and Gcoin (G-Coin). The only oil-backed cryptocurrency is Venezuela’s “national cryptocurrency”, the Petro.

3. Crypto-backed stablecoins

Crypto-backed stablecoins are those that are backed by other cryptocurrencies, usually the ones with the largest market caps such as Bitcoin and Ethereum. Crypto-backed stablecoins can be backed by either one cryptocurrency or a mix.

Due to the volatility of cryptocurrencies in general, most crypto-backed stablecoins are backed by a mix of cryptocurrencies to offset the risk of holding just one cryptocurrency as collateral. Crypto-backed stablecoins are usually over-collateralized in order to account for fluctuations in the price of the underlying cryptocurrency. This helps to maintain the stability of the stablecoin at a set price.

Examples of well-known, crypto-backed stablecoins are DAI (Maker DAO), bitUSD (BitShares) and sUSD (Synthetix).

4. Non-collateralized stablecoins

Non-collateralized stablecoins are stablecoins that are not backed by any assets but use algorithms to adjust the supply and demand of the stablecoin in order to keep the value stable.

Examples of non-collateralized stablecoins are CarbonUSD (Carbon) and kUSD (Kowala).

How should you evaluate a stablecoin?

While stablecoins are being hailed as the new poster child of mainstream adoption of cryptocurrencies, stablecoins, just like any other crypto projects, should be assessed carefully before investing in it.

Stablecoins should be assessed on the following:

- What is the asset backing it?

- How stable is the asset backing it?

- Are there any controls in place to ensure that the stablecoin has enough of the assets in reserve through independent security/reserve audits?

- For reserve-backed stablecoins, has the project named their banking relationship so investors can assess the counterparty risk (i.e. is it an unknown off-shore bank or an established and reputable banking partner)?

- Does the whitepaper make sense? Is it clear how the stablecoin is being backed?

- Is information on the team behind the project easy to find and visible on the website? Are LinkedIn profiles linked to each person’s photo and are any advisors clearly listed, with industry related expertise?