Bitcoin has been relatively quiet ever since it posted its 2019 high of $13,880 on June 26. From that point, the market has been on a steady pullback with a few short-lived rallies. Experienced traders would call the price action as “choppy,” where there are no big moves and the trend is mostly sideways.

A choppy market is not exciting for day traders because there are no wild swings to profit from. It is also boring for momentum traders and trend followers because they have to wait for the resumption of the trend.

We looked at the charts and it seems that the days of dull trading are numbered. Bitcoin appears ready to make a big move soon and it is leaning toward the side of the bulls.

THE BITCOIN HISTORICAL VOLATILITY INDEX CLOSING IN ON THE SUPPORT

The Bitcoin Historical Volatility Index (BVOL) has been on a downward spiral ever since it skyrocketed from a low of 4.38 to a high of 14.06 on the same day, June 26. That’s the same day bitcoin printed its 2019 high.

Before the index spiked by 9.68 points in a single day, it consolidated at support of 2.00 for about a month. During that period, there were several upticks in volatility but nothing compared to the June 26 ascent. Nevertheless, 2.00 is a key level for the index.

Currently, BVOL is about to drop to 2.00, which is a level where bitcoin usually reacts. Most of the time, volatility favors the bulls when the index plunges to 2.00. However, there are instances when bears win the day and the index falls further.

Whatever the case may be, 2.00 is a level where we can expect a resumption in volatility. Up or down, market participants are about to make a decision soon. Fortunately for bitcoin holders, the charts favor the bulls.

TECHNICAL INDICATORS PROJECT A BULLISH BREAKOUT

Looking at the daily chart, there’s no doubt that bitcoin has been in an uptrend since February 2019. In addition to that, there are multiple signals that predict a bullish breakout.

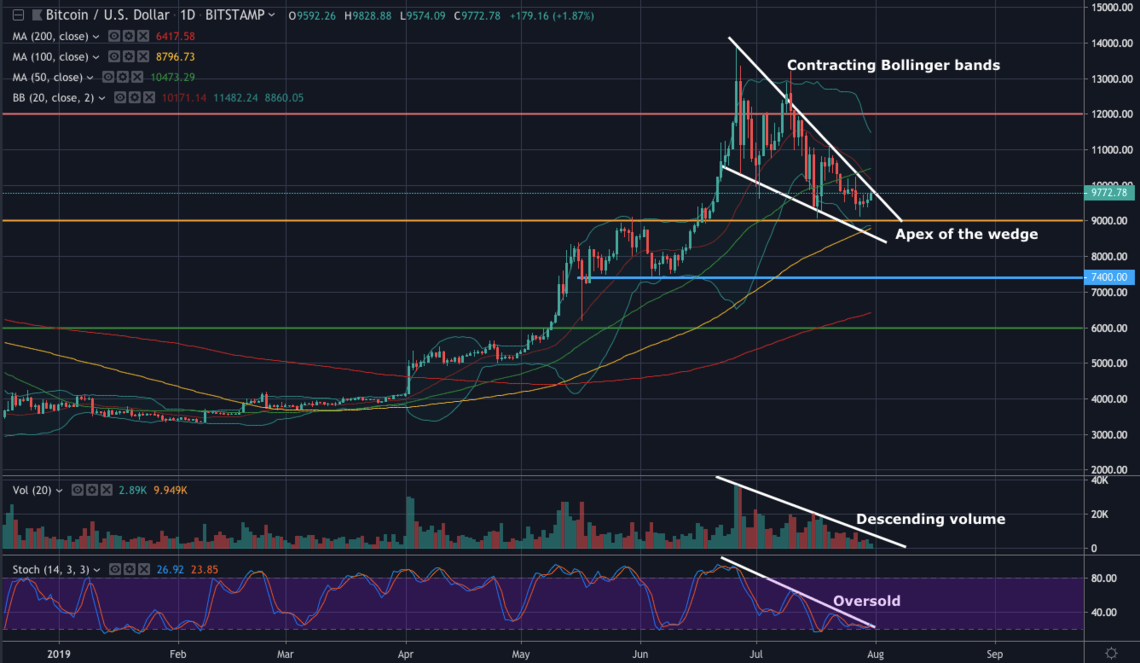

First, we see the Bollinger bands contracting. This indicator tells us that the daily trading range is narrowing. The contraction of the bands actually affirms our assertion that a surge in volatility is on the horizon.

Interestingly, the narrowing trading range coincides with the formation of a falling wedge. Now that the bands are contracting, we can see that the price is close to the apex of the wedge. Keep in mind, a falling wedge is a bullish continuation pattern. It often comes with a decrease in volume and momentum. We’re seeing those conditions on the daily chart.

Volume has been declining since June 26. In addition, the daily stochastics is flashing oversold readings.

All in all, we have a great setup indicating a big move up. Even with this confluence of events, bulls must show up to complete the breakout. Otherwise, bears will likely smell weakness and they would not hesitate to capitalize.

BOTTOM LINE: BUY ON THE BREAKOUT

The Bitcoin Volatility Historical Index is fast approaching its jump-off point, but that doesn’t mean that investors should quickly jump the gun. It would be wise to wait for a bullish breakout before placing buy orders. A falling wedge breakout may likely send the bitcoin price close to $12,000. On the other hand, a breakdown may likely push the market down to $7,400.

Up or down, the time for bitcoin to make a decision is at hand.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.